Diversifying Income Streams: From Pay Checks to Investments and Side Gigs

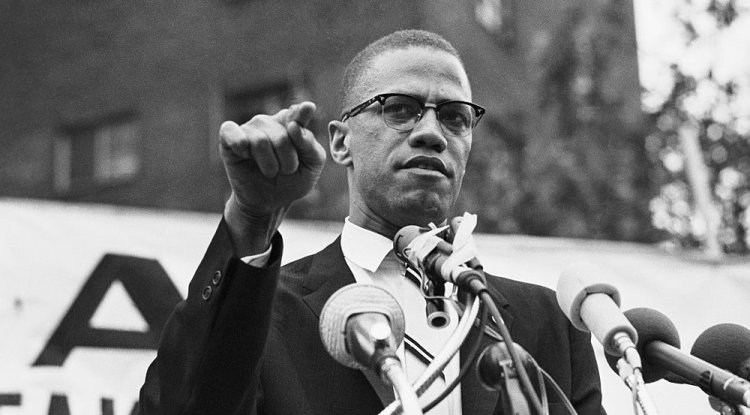

Black America has to start thinking differently for the future to survive. Diversifying income opportunities is the new way to financial liberty.

The economic playing field has changed behind the Internet revolution. Long-term careers are long-fading, along with pensions and corporate retirement packages. Since the Internet expansion, working 9-5s, forty-hour work weeks and office politics are fading into a past time.

The lottery has been a long-time hustle on the Black community draining any extra disposable income we get; gambling is being introduced into our communities to bring another addition other than crack cocaine, and there is little to no generational wealth being past down in the Black community. Black America has to start thinking differently for the future to survive.

College diplomas will bring us so far into the workforce as we face new attempts to nullify DEI and are increasingly facing systemic racism on the job. Diplomas, in fact, are weighed against student loan debt and salary whether it is worth it or not. However, many Black graduates are taking their degrees and establishing their own niche clientele.

We are leaning new trades, specializing and starting business in expanding markets such as Network Security, coding, programming and AI; also, renewable energies such as Solar, wind, and natural gas either by sales, consulting transport or teaching. Not to mention taking advantage of older trades such as plumbing, electricians’, HVAC and new home construction.

For the more laid-back entrepreneur, work from home and gig work have taken hold of a generation who does not see the point or benefit in working for corporations that tie them to desks giving performance-based, bi-weekly pay. People are seeking newer, more innovative career choices like starting their own business in ecommerce drop shipping, gig work, and content creation, and many are finding out that investing is a way of life toward a lifetime of residual income.

The hustle has gotten real and overnight millionaires are becoming more common. Diversifying income opportunities is the new way to financial liberty. Always adding investing into your side hustles. Saving for the future has become almost impossible in this economy where every cent a person makes goes toward a bill or some debt.

More people are looking to more diverse income streams and instead of working two or 3 part-time jobs, they are creating their own jobs. One rule is if a person can find something to do that other people do not want to do or will pay for, they will find a market that could sustain them for years into retirement.

If self-employed, many people are locked out of the corporate 401k type retirement plans, but there are retirement plans made specifically for the self-employed and small business owners. One is a Simplified Employee Pension (SEP) IRA. This is mainly designed for business owners and self-employed individuals. With a SEP IRA, contributions are made by the employer and are tax-deductible.

There's also the option of a Simple IRA (Savings Incentive Match Plan for Employees). This is typically offered by smaller businesses, and both employers and employees can make contributions. Similar to a traditional IRA, contributions are often tax-deductible. And if you work for or run a non-profit organization, you may have access to a 403(b) plan. These plans are like 401ks but are specifically for employees of these entities.

Now, keep in mind that each alternative has its own rules and regulations, so it's important to do your research and consult with a financial advisor to determine which option suits your needs best.

One of the fastest growing income streams is investment income. One of the hottest markets to get into right now is AI (Artificial Intelligence) and renewable energy. These are going to explode like ecommerce and online search engines did in the early 2000s. Intel chips and microprocessors are built into these markets and are always good investments for the long term.

Furthermore, investing has become easier and more user-friendly and accessible to working people through online brokers and websites. Simply google online investment companies and learn all you can about investing. Tax refunds are a good starting point to buying shares.

Remember, it's important to research and compare the fees, services, and investment options of different companies before making a decision. Additionally, consulting with a financial advisor can be beneficial in determining the best investment company for your specific needs and goals.

If people do not start to diversify their earnings within the next decade, they may be left behind in this new economy. Corporations are relentless in not paying living wages in an economy that continues to raise prices on everything. Residual income is the thing now, not pay-check-to-pay-check living. Find a hustle that will pay as you sleep.